The financial landscape is evolving rapidly. With persistent concerns over inflation, national debt, and market volatility, many investors are proactively seeking alternatives to traditional stocks and retirement accounts. They seek control, autonomy, and a reliable store of value that stands outside the banking system. The strategic answer for a growing number of financially literate individuals is physical precious metals.

While gold historically commands the spotlight, silver is currently positioned as one of the most compelling and strategic assets of this decade. It possesses a unique dual identity serving both as a traditional monetary metal and as an indispensable industrial commodity, driving a structural market deficit that shows no signs of slowing.

This guide will empower you to confidently navigate the digital landscape, understand the strategic case for silver investment, and take direct, tangible ownership of high-purity physical silver online. Buy Silver. Own Power.

Silver isn’t just shiny, it’s strategic. For risk-aware investors aged 30 to 55 looking for a powerful inflation hedge and a way to add diversification, silver offers an ideal entry point and powerful leverage to future technological trends.

Silver is significantly more affordable than gold, making it the perfect first step for new precious metals investors. Unlike gold, which requires a substantial capital outlay, silver allows investors to begin building a meaningful position through regular dollar-cost averaging. This accessibility is critical for those focused on steadily building generational legacy and tangible wealth without overextending their immediate portfolio.

Furthermore, the historical relationship between gold and silver, known as the Gold-to-Silver Ratio, is still far above its historical average. This suggests that silver is currently undervalued relative to its yellow counterpart, signaling high mean-reversion potential and offering investors the opportunity for outsized returns once the ratio corrects.

Unlike gold, where only 10% to 15% of demand comes from industry, roughly 60% of silver is consumed by advanced industrial applications. This makes silver’s price action fundamentally tied to global economic growth and technological adoption, providing a price floor that purely monetary metals lack.

The single largest driver of this demand is the global shift toward clean energy. Silver’s unmatched electrical and thermal conductivity makes it an irreplaceable component in high-efficiency technologies:

Experts project that silver mining production will struggle to meet this relentless industrial demand, leading to structural market deficits where demand consistently outstrips supply for the fifth consecutive year. This persistent tightness in the physical market creates a powerful, long-term bullish outlook for silver prices.

For investors concerned with financial stability and systemic risk, the choice between paper silver and physical silver is arguably the most critical step in the entire investment process.

Paper silver refers to financial instruments that track the price of silver but do not grant direct, tangible ownership of the metal itself. These include:

The fundamental risk associated with all paper assets is Counterparty Risk. When you hold paper silver, your investment’s value depends not just on the price of silver, but also on the solvency, trustworthiness, and operational stability of the issuing bank, custodian, or fund manager. In times of extreme financial stress, access to the underlying asset can become restricted or impossible.

Physical silver, such as high-purity bars and coins, gives you full ownership with zero counterparty risk. Your wealth exists tangibly, independently of any institution, brokerage, or government system. This is the essence of true wealth preservation, a direct, time-tested hedge against financial instability and currency devaluation.

GoldMogul’s mission is to democratize access to physical precious metals through secure, transparent, and modern digital experiences. Follow these steps to complete your investment safely and confidently.

Before making a purchase, educate yourself on key terms and current market dynamics:

Purity: Ensure the metal is investment-grade, typically pure (e.g., 0.999 fine silver).

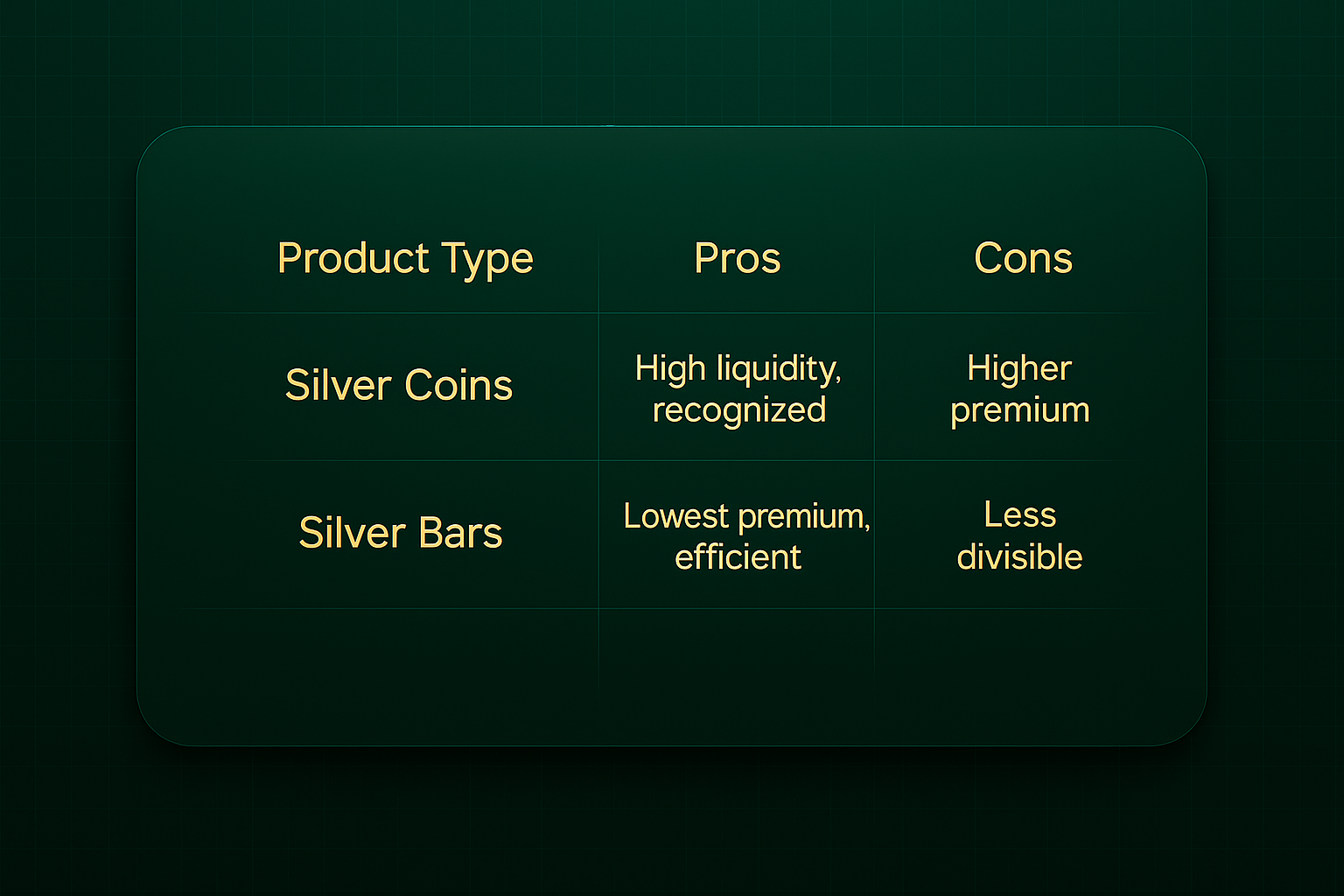

The form of the silver affects the premium, liquidity, and storage efficiency. GoldMogul offers 99.9%+ pure metals to suit every strategy:

For serious, risk-aware investors looking to minimize premium, the 100-ounce silver bar is often the most cost-effective way to build a core physical holding.

The platform you choose dictates the security and peace of mind you gain. A modern precious metals dealer must prioritize transparency and security over everything else.

Checklist for Online Platforms:

GoldMogul fulfills this requirement by providing transparent pricing, insured delivery, and guaranteed 99.9%+ purity in all our assets, stored in accredited, secure vaults globally.

Once you’ve selected your product, you must decide on the storage method.

Insured Delivery: For smaller allocations or emergency reserves, direct delivery is possible. The delivery is fully insured door-to-door, requiring a signature upon arrival. Note: Ensure your home insurance policy covers precious metals if you choose this option.

Purchasing involves securing the price, known as “locking in” and completing the payment. Due to the high volatility of the silver market, the price is locked at the time of your order execution, typically for 24-48 hours until payment is received.

Once your silver is secured, you can monitor its value and market performance directly through the GoldMogul online dashboard, treating silver as the core, long-term wealth preservation asset it is intended to be.

We understand that owning tangible assets is about gaining confidence and control. Our platform is built specifically for the risk-aware, financially literate investor who values security and legacy.

GoldMogul’s commitment to transparency means you always know exactly what you own, where it is, and what you paid for it. Our metals are sourced from accredited refiners, guaranteed 99.9%+ pure, and held in audited, secure facilities always available for delivery or redemption. We eliminate the opaqueness and complexity often associated with traditional dealers, positioning ourselves as the easiest, safest, and most trustworthy way to invest in silver online.

We believe every investor, big or small, can confidently own time-tested assets. By choosing physical silver through a modern, secure platform, you are taking ownership of power.

A: Silver’s strategic case is its Dual Identity as both a Monetary Metal (inflation hedge) and a Critical Industrial Commodity (green energy). This combination, driven by persistent Supply Deficits, creates a strong long-term outlook that positions it as a powerful asset for diversification.

A: Physical silver guarantees full ownership and zero counterparty risk, meaning your wealth is independent of any bank, brokerage, or fund manager’s solvency. Paper silver is merely a fractional claim on the metal, carrying systemic and custodial risks that undermine silver’s core role as a safe-haven asset.

A: The highest demand comes from the Green Energy Transition, primarily the Photovoltaic (solar) sector and Electric Vehicle (EV) manufacturing. Silver’s unmatched electrical and thermal conductivity makes it irreplaceable in these high-efficiency, high-growth applications, leading to a persistent supply deficit.

A: Investors must understand Spot Price (the current market price) and Premium (the dealer cost for fabrication, handling, and insurance). They should prioritize purchasing investment-grade bullion (bars or generic coins) with at least 99.9%+ purity to minimize cost and maximize value.

A: GoldMogul combines Modern Digital Convenience with Timeless Security. This is achieved through transparent pricing, guaranteed 99.9%+ purity, insured delivery, and real-time tracking of assets stored in accredited vaults, giving investors full visibility and control over their assets.

A: For investors seeking to minimize the premium per ounce and maximize storage efficiency, the 100-ounce silver bar is generally the most cost-effective option for building a core, long-term physical holding.

GoldMogul is backed by American Bullion, a pioneer of the Gold IRA since 2009

12301 Wilshire Blvd. Ste. 305

Los Angeles, CA, 90025

1-800-465-3472

2024 GoldMogul All rights reserved.